Imagine your life without access to a bank account. Imagine having your life savings stashed under your mattress or your kitchen sink, hidden from potential thieves. Imagine having no pension or financial security. Now imagine the lives of around two billion people worldwide, for whom a life without access to financial freedom is very real.

For most of us, making bank transactions is so simple and automatic that it goes unnoticed. Withdrawing money from an ATM is as easy as breathing or walking down the street. We do our weekly grocery shopping with a swipe of a contactless card and pay for mid-sized dreams with a credit card. Starting a business, no matter how small, is daunting but possible, thanks to a plethora of different loans available through banks, governments and organisations. We get life insurances that prepare our family members for the worst and travel insurances that make sure that we get what’s ours when an airline loses our luggage on our way to our next holiday destination. For most of us, access to financial services is a seeming given. It’s a very specific kind of freedom that doesn’t seem novel. Yet, for around every third person on earth, this is far from reality.

Chapter 1: What does it mean to be unbanked?

Today, a little under two billion people — 31 per cent, or every third person — are unbanked. The Cambridge Dictionary defines an unbanked person as a person with no bank account. A lack of access to banking services is crippling. Without a bank account, you are exempt from insurances, pensions or any professional money-related services. Access to politics and legal services is more difficult to gain. Not having a bank account means no ability to transact online which in turn leads to not being able to invest and having to fear being subject of robbery. Fraud protection is minimal and you are stripped of an ability to buy land, property or businesses.

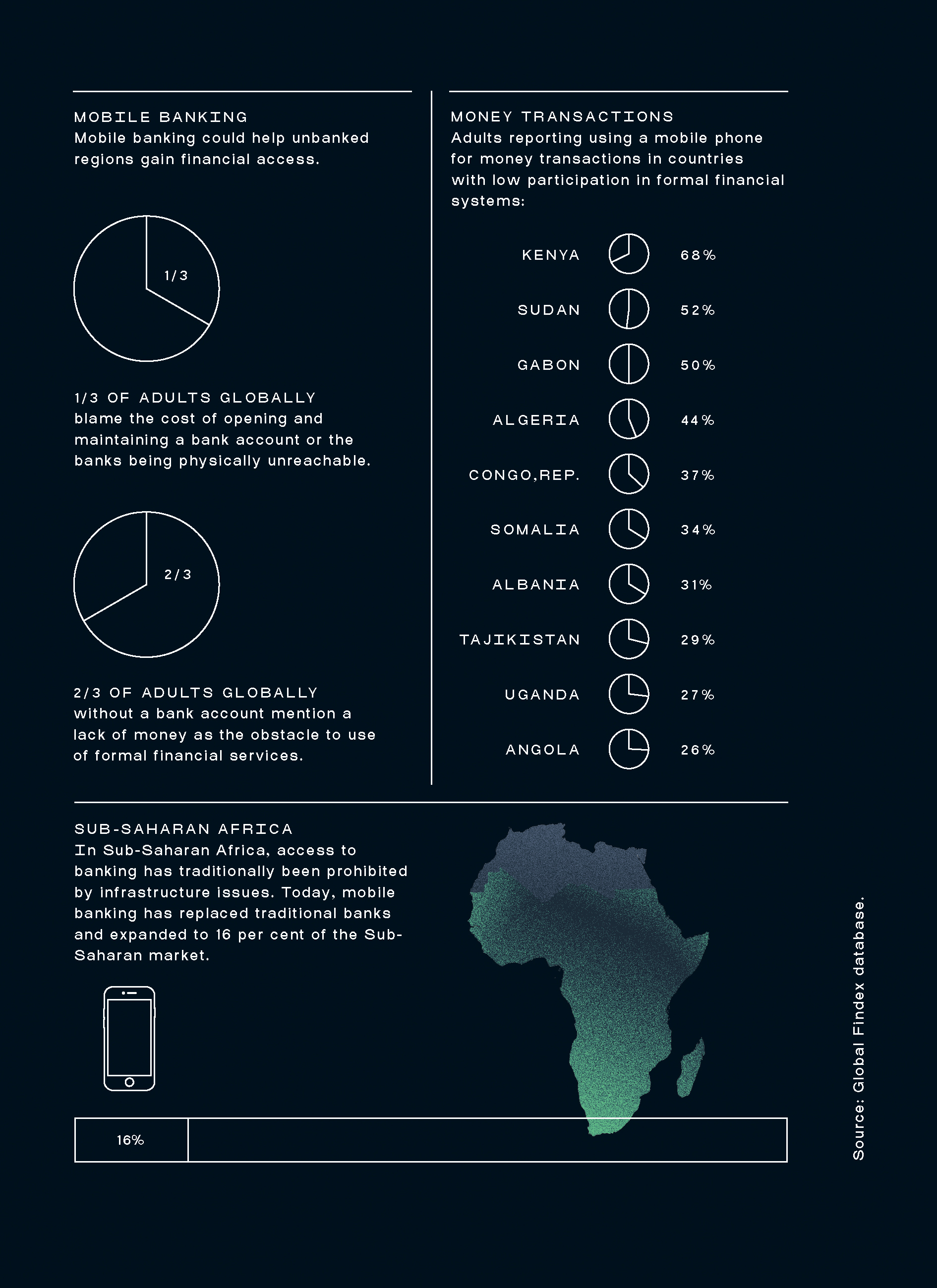

The reasons for being unbanked vary. In 2017, the Global Findex survey mapped out the main reasons for not having an account at a financial institution. The most common barrier is obvious: a lack of money; around two-thirds of adults without a bank account cited a lacking amount of money to have one as they primary reason for not having one. Documentation poses an issue, as well as lacks in infrastructure, physical bank branches, security and travel costs. As around 75 per cent of unbanked adults live in poverty, banking doesn’t come cheap and a day spent running banking-related errands could mean a loss in a day’s income.

Chapter 2: Who are the unbanked?

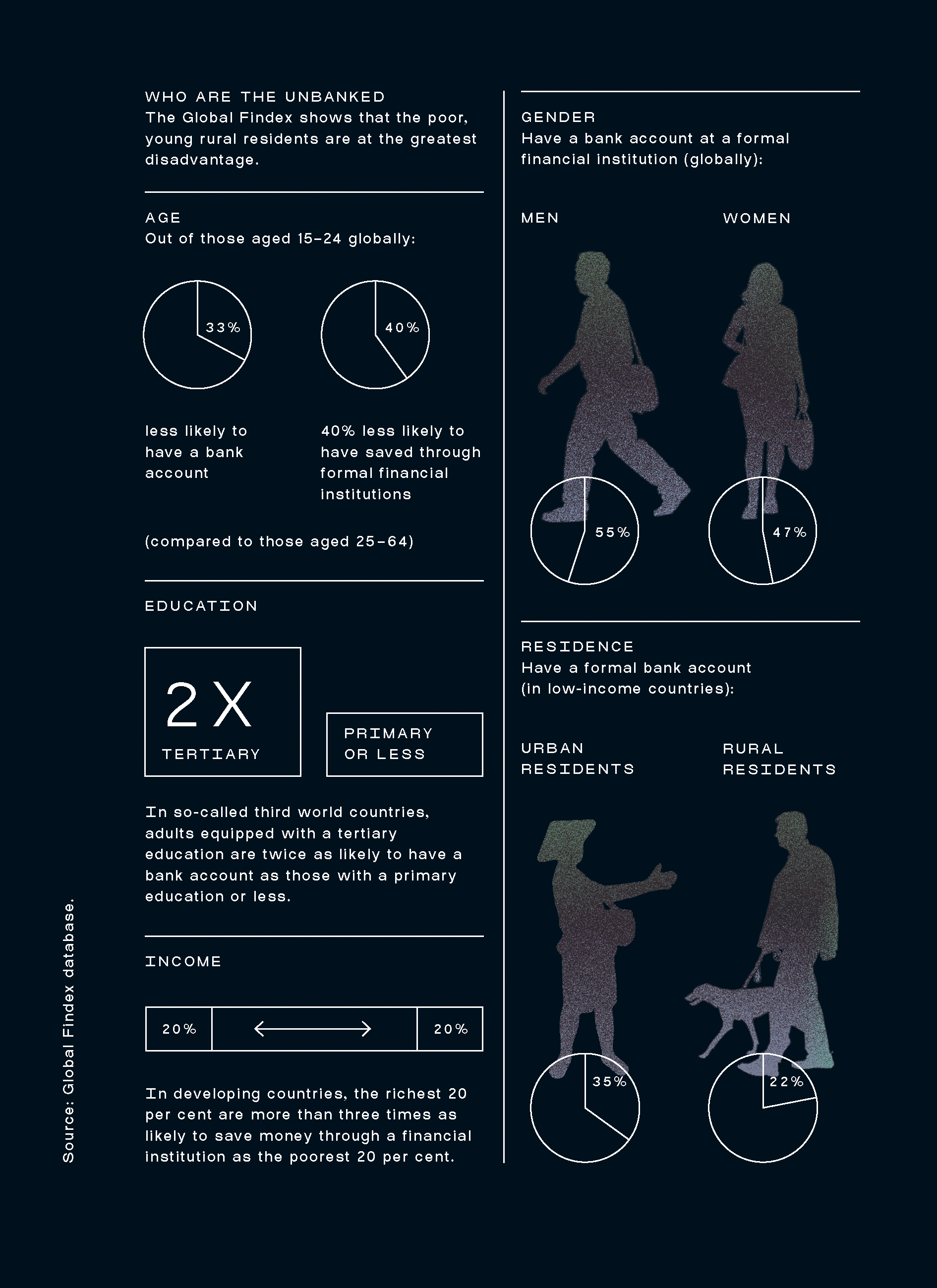

A typical unbanked adult is a young, uneducated and poor woman.

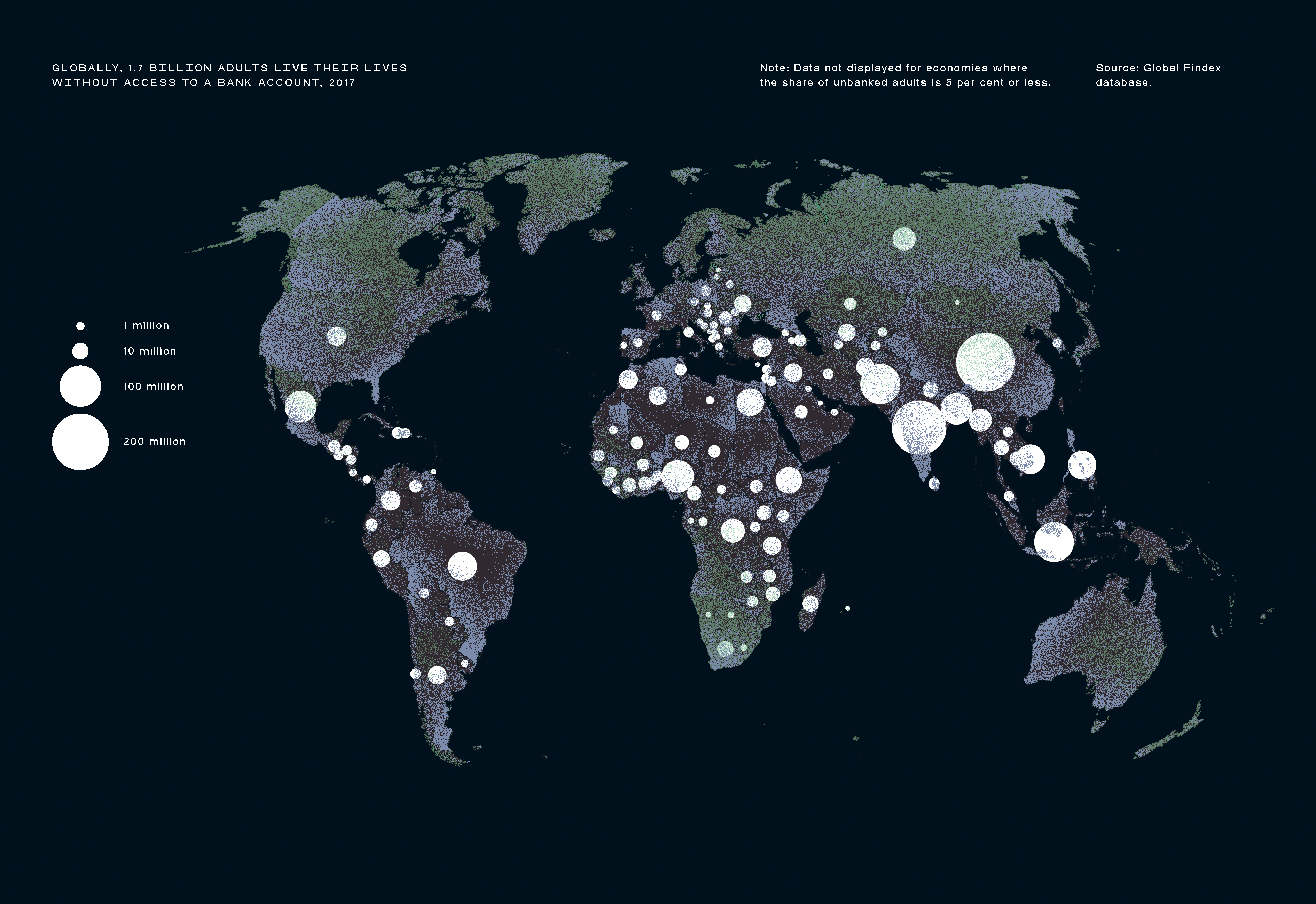

Although in the US, almost a third of the population suffers from a lack of adequate financial services and almost 10 million American households are unbanked, being unbanked is traditionally an issue that touches countries that have lower than average GDPs. Almost all unbanked adults live in developing economies. China, India, Pakistan and Indonesia, along with Nigeria, Mexico and Bangladesh, account for half of the unbanked world.

Not having access to formal financial services isn’t about being employed. Unbanked adults aren’t necessarily unemployed — they just live in a world of financial instability. Out of all the unbanked adults who work in the private sector, 200 million are paid in cash only, as are the 200 million who receive payments for agricultural services. According to World Bank Data, more than a fifth of unbanked adults receive their pay checks and government transfers in cold hard cash — the same way that they pay bills, rents and school fees.

Lastly, being unbanked is highly gendered: women are more likely to have no access to banking services than men. Approximately 980 million women don’t have access to a bank account — 65 per cent of all unbanked people in the world. In India and China, women make up 60 per cent of all unbanked adults and out of the one-fifth of Kenyan unbanked adults, two-thirds are women. Despite increasing evidence of women lifting entire families out of poverty — with financial tools at their disposal, women tend to invest in their families and start ventures that drive broader economic growth — there remains a stark gender gap that could be hindering the growth of developing countries.

Chapter 3: Why is being unbanked a global issue?

Although on a surface level being unbanked may seem like an issue that only affects individuals, it has widespread national and global repercussion. A lack of banking services could mean a nation devoid of social mobility and, by association, prosperity. A country mostly made up of individuals with no access to financial freedom is a crippled country. Moving from an informal economy to a system supported by formal financial services drives national economic growth that in turn leads to social development and a reduction of gender inequalities and poverty. Turning the 1.7 billion unbanked adults into people who can get loans, grow their businesses and help their communities could mean a global shift in wealth distribution.

According to the World Bank, financial inclusion is a key enabler in decreasing poverty and enhancing prosperity, both on an individual level as well as nation-wide. Lacking financial inclusion prevents people from making and receiving daily payments, thus making it difficult to exit extreme poverty. Relying on unofficial monetary services locks these people into a cycle of hard-to-break dependency. Without access to financial services, it is difficult to widen your business from the informal sector to the formal sector. In essence, you’re stuck growing small-scale crops and keeping a minimal amount of animals; or selling basic items and small-scale artisanship. Without an ability to tap into credit, growing a business is nearly impossible. Living in an informal economy is a trap that keeps the poorest poor.

Chapter 4: Is there a way to fix this?

The root causes of being unbanked are multiple and difficult to fix but an answer might be closer than we think — right in our pockets. Take a walk down the -crowded and humid streets of Yangon — the capital of Myanmar, one of Southeast Asia’s poorest countries — during monsoon and you’ll see monks covering their Samsung smartphones’ screens with their palms and smartphone sellers scurrying to shield their wares from the rain. It’s visible and audible: Low GDPs and poverty are no longer synonyms for not being equipped with a smartphone. The numbers speak loud — out of the 1.7 billion unbanked adults, two-third own a smartphone. Over a billion people are out of reach of mobile banking applications but are still able to use other kinds of applications that could help lift them out of an informal economy. Although only two per cent of adults worldwide own a mobile money account, over a tenth of Sub-Saharan Africa has one and nearly half of adults in developing countries reported making or receiving at least one digital payment in the last year. The scarcity of commercial banks’ interest has led to a market for mobile money services that overlook physical barriers.

Cryptocurrencies could provide relief for those who are waiting for traditional banks to realise that they have a responsibility to develop banking services that cater to the unbanked. Whereas access to a bank branch requires travelling, enough money and documentation, cryptocurrencies aren’t bound by practicalities. In addition to this, by bypassing state control, they are independent and safe from the potential volatility of the economics of developing countries. Holding cryptocurrencies doesn’t cost a penny and are accessible to paperless immigrants as well as women suppressed by gender inequalities. Despite not being a perfect solution, cryptocurrencies could bring about the first wave of change and make it easier for unbanked people to save, trade and safe keep their money. If incentivised, for-profit companies could increase internet availability and grow infrastructures in places in which financial growth has stagnated. When global internet usage penetration grows, the opportunities will grow, too.

Technological change could bring about economic and social change, but whether cryptocurrencies deliver on their promise remains to be seen. In the meantime, the unbanked population of the world is waiting for banks to realise that being unbanked is a financial state that not only hinders an individual’s life but also the progress of entire countries and thus, the world.

Money around the world is a series that explores global, money-related questions.

Words: Matilda KiveläInfographics: Agency Leroy

Published 21.08.2019