Payroll services you can rely on

Ensure smooth payroll management for your business with our quality payroll services. We make sure your employees get paid correctly and on time. Join the group of our satisfied customers!

High quality ensures payroll reliability

Regular monitoring and reporting of payroll accuracy is at the core of Greenstep’s quality of service.

- We use automation and comprehensive integrations to streamline our operations and minimise manual processes and the resulting human error

- We ensure the efficiency and accuracy of our payroll service by utilising comprehensive analytics and AI for data verification

In addition to high quality, regular quality monitoring enables continuous improvement of processes and practices.

This is the recipe for our qualityGreenstep as a payroll partner

When you choose Greenstep as your partner in payroll services, we will commit to continuously develop our service package and build a strong trust-based partnership with you and your payroll team. We will form our team according to your needs and ensure that your specific payroll needs will be fulfilled.

We are constantly developing our payroll expertise, processes and software, so our service will be flexible and scalable according to your needs. To complement your own team, we have payroll experts in Estonia and in the Nordics alongside our strong team in Finland.

Read more about our partnership model

We offer payroll services globally

Read morePayroll across borders

We offer our services locally in Finland, Sweden, Norway and Estonia. Over 1000 customers trust us as their dedicated payroll partner.

Trusted partners everywhere

In addition to our local offices, we are a part of the MSI Global network, which enables us to provide payroll services with our partners across the globe.

Local expertise guaranteed

We know the local laws and regulations, so we comply with local legislation and improve efficiency across the Group.

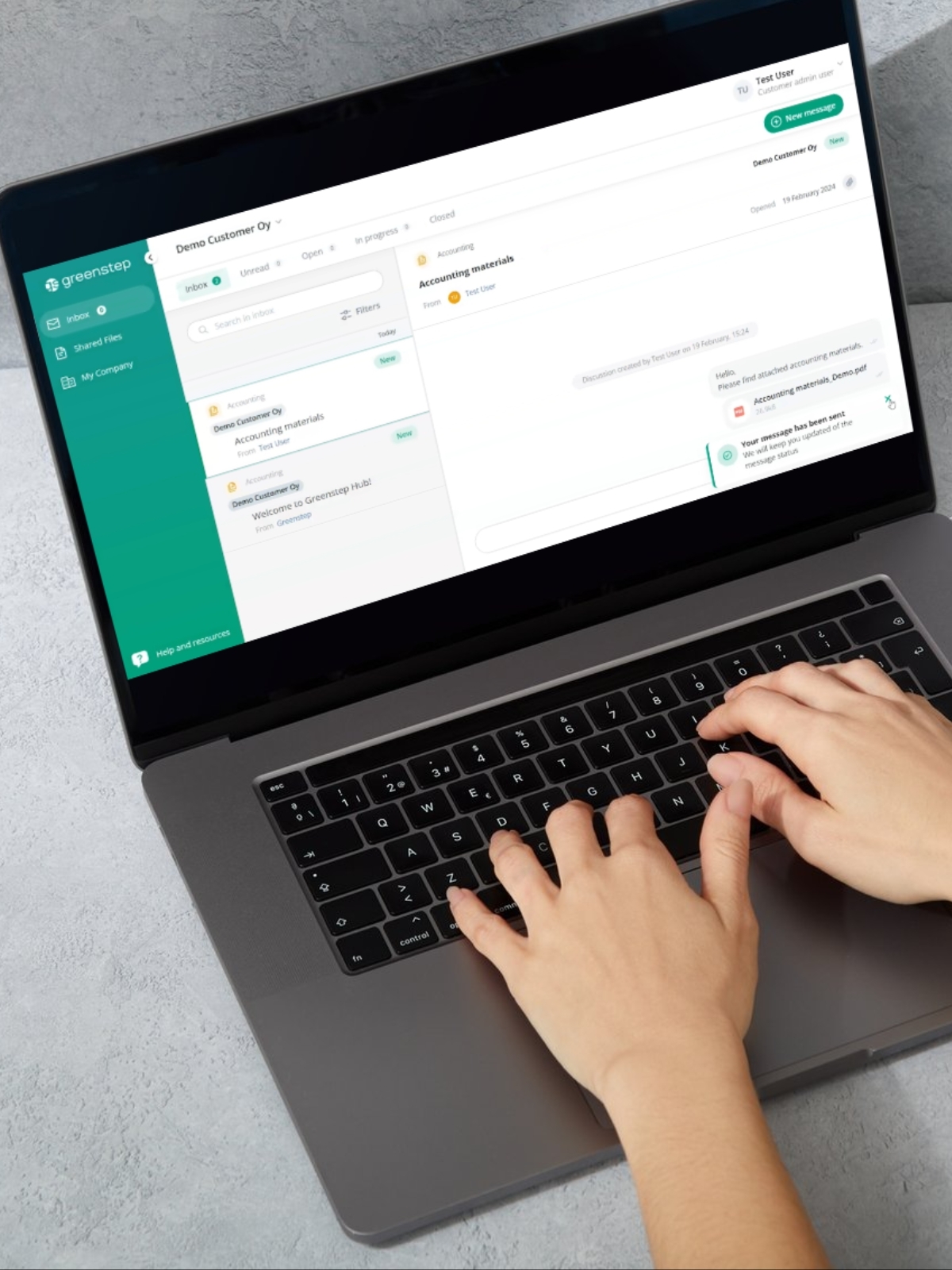

Greenstep Hub – the 100% secure and efficient way to communicate and deliver payroll data

Payroll service always involves a lot of confidential discussions and data transfers.

We have developed our own customer portal, Greenstep Hub, for secure and carefree communication. The Hub is developed for group-to-group communication – it allows both your own team and the Greenstep payroll team to always have all the information and messages they need on one platform, without having to share information separately, for example in case of sickness absence.

We are an ISO27001 certified partner. This means that as a customer, you can be sure that your information is handled