Could NetSuite work for your consolidation needs?

When you have subsidiaries that you own 100% of, consolidating in NetSuite is like smooth sailing.

You can drill down to source transaction details, and consolidation postings are done automatically, and unified reports (P&L/BS/Elimination sheets) are available in real time.

But when you have a more complicated structure with partial ownership or complex intercompany agreements, you may find it difficult to configure NetSuite to handle all scenarios correctly.

To sum it up – you can either consolidate directly in NetSuite, using customized automation in NetSuite, in excel or using an external consolidation software. Regardless of which consolidating route you chose, it’s worthwhile investing time and energy to get it setup correctly from the start.

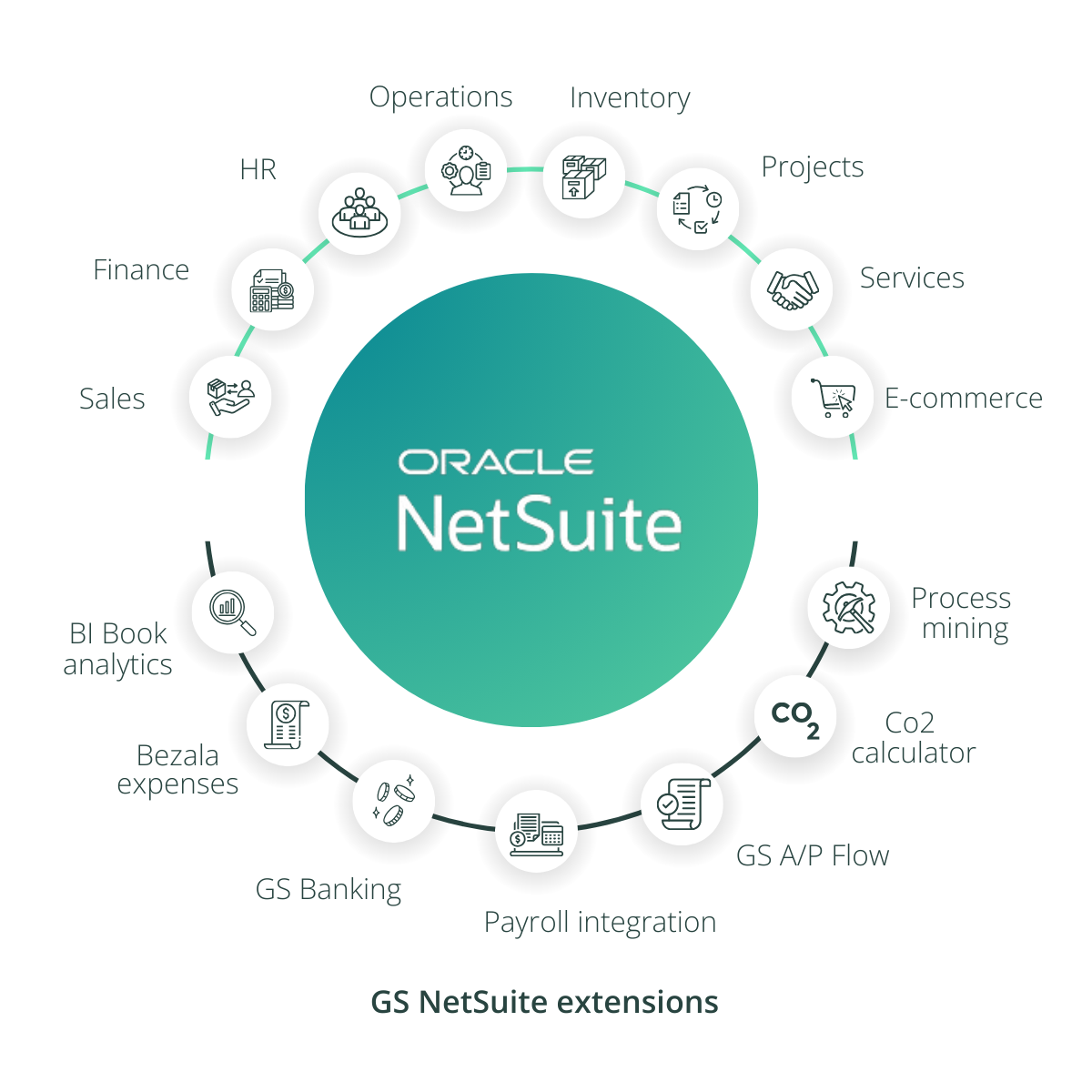

Greenstep has set up clients that consolidate using NetSuite’s native solutions. We’ve developed our own advanced automation of intercompany transactions and eliminations. We’ve also implemented consolidation software AARO, and other external consolidation software for multiple clients.