Mastering financial forecasting in uncertain times: Scenario planning and stress-testing with real-life data

When the global economy lurches with every new tariff, supply chain disruption or interest rate shift, long-term financial planning can start to feel more like guesswork than strategy. For financial leaders, mastering forecasting isn't about being exactly right - it's about being ready for what ever might come next.

That's where scenario planning and stress-testing come into play. Together, they help organisations stay resilient in a world that changes without warning.

Why forecasting feels impossible right now

When you look at today's economic climate, CFO's aren't just forecasting numbers, they're forecasting instability.

Global developments, such as sudden tariff impositions, commodity price volatility, interest rate fluctuations and localised regulatory shifts or ESG risks, can derail even the most carefully considered financial plans.

This level of uncertainty demands a new mindset: plan for the unexpected.

And that means building flexible, data-driven models that allow your organisation to test how it would perform under pressure.

Scenario planning: what if everything changes tomorrow?

Scenario planning begins with a simple question: What happens, if...?

- What if raw material costs increase by 30% overnight?

- What if turnover drops by 15% in a key region?

- What if exchange rates shift dramatically?

By modelling different future scenarios, from best to worst case, finance teams can identify weaknesses, challenge assumptions and develop deeply thought out contingency plans.

But doing this effectively requires live data, agile tools and the ability to model change quickly.

Stress-testing: taking your forecast to the gym

Stress-testing applies extreme, but plausible, conditions to your financial model:

- The sudden loss of a major customer

- Sharp increases in borrowing costs

- Unforeseen regulatory fines or tax changes

The goal of stress-testing isn't to predict a catastrophe, but understand how your business would hold up if one should occur.

From spreadsheets to real-time visibility

Most companies still rely on Excel for forecasting. While it's familiar, it's also time consuming (manual consolidation and version control create delays), static (can't adapt to weekly market movements) and siloed (different teams' data rarely integrates cleanly).

To thrive in uncertainty, finance teams need smarter tools. That's where BI Book Planning steps in.

How BI Book Planning brings forecasting to life

BI Book Planning provides a faster, more intuitive and collaborative way to plan financially. Here's how it works.

1. Real-life data, automatically consolidated

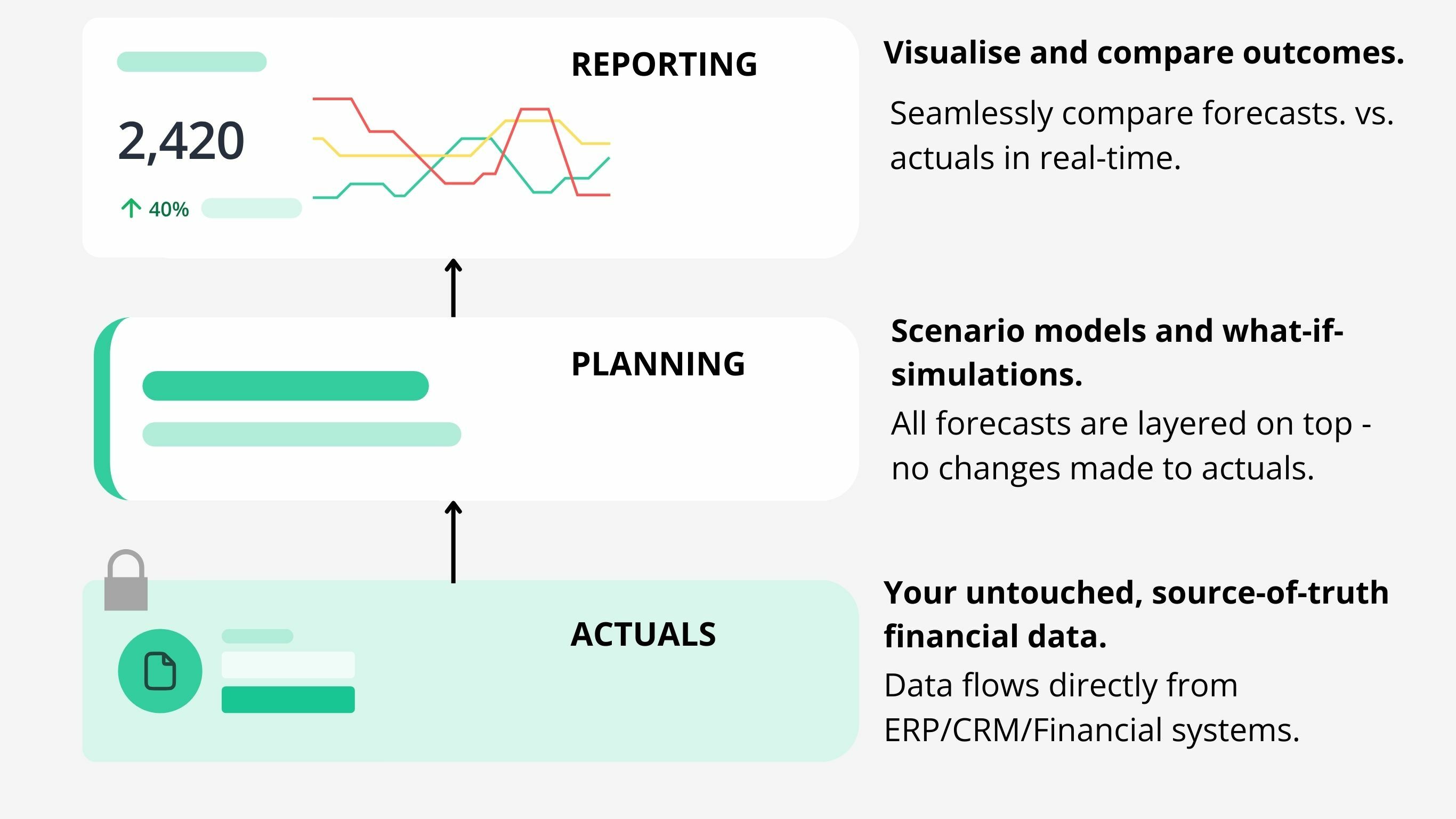

Rather than relying on manual uploads, BI Book connects directly to your existing systems - ERP, CRM, finance platforms etc. - and consolidates data into a centralised data platform. This ensures you're always working from a single source of truth, updated in real time.

2. Scenario modelling built into Power BI

Because it runs on top of Power BI, finance teams can:

- Create forecasts based on actuals

- Layer in multiple scenario models

- Run "what if" simulations in seconds

- Collaborate with stakeholders across departments

Crucially, BI Book Planning allows you to explore different scenarios without ever compromising your historical data. Actuals remain intact and untouched, ensuring the integrity of your financial records while giving you the freedom to plan ahead with confidence.

And because the planning layer is linked to real data, your forecasts aren't theoretical - they're grounded in the business as it is today.

3. Stress-test the plan, visually and dynamically

BI Book Planning makes in easy to apply percentage changes to key variables, model market downturns or shocks and visualise how different assumptions impact performance.

All within a highly visual, interactive interface that helps both finance and non-finance leaders understand the implications, and act on them.

Take control of the uncertain

Forecasting in 2025 isn't about precision, it's about preparedness.

In a topsy-turvy world, where tariffs, geopolitics and economic shocks can upend your numbers overnight, agility matters more than accuracy.

With BI Book Planning, you can stop reacting and start preparing, with data-backed scenarios, collaborative forecasting and real-time stress-testing built into one flexible platform.

Want to see BI Book Planning in action?

Book a short demo to explore how BI Book Planning can help your organisation stay one step ahead, no matter what the future holds.

Published 23.05.2025