Sustainability reporting is getting to be more interesting to companies, because it directly affects the valuation of the company. The key stakeholders have different reasons to be interested in the company and it’s sustainability matters.

Investors expect companies to act more responsibly. Sustainability therefore has a direct impact on how companies can get funding in the future.

Employees, especially young people, value sustainability matters and are looking for companies whose values and actions they can relate and commit to.

Customers also increasingly expect companies to act responsibly. They make choices based on how companies act in relation to, for example, society and the environment.

The need for information is growing and companies need to know and be able to measure the impact of their actions. Reporting on these matters must be done in a controlled and planned manner, both internally and externally.

The era of voluntary sustainability is coming to an end

Until now, corporate responsibility has been driven by pioneers. Companies have been able to choose how responsibly they act, within certain limits of course.

This era of voluntary sustainability is coming to an end. The main regulatory pressure comes from the EU, whose regulations trickle down quite directly into national legislation. As a result, several pieces of legislation will enter into force that will be binding on businesses.

Several reporting requirements have recently come into force, for example on financial markets. For example SFDR, the Sustainable Finance Disclosure Regulation, aims for transparency of financial market conduct and the prevention of greenwashing.

Taxonomy has been a big topic of discussion over the last couple of years. It means that companies are classified as either green or not green. This is intended to guide the financial markets and to give boost to EU’s green transition projects.

Today’s burning topic is CSRD, Corporate Sustainability Reporting Directive, and soon, in the near future a new CSR law will be on the agenda, extending corporate responsibility to value chains and due diligence issues.

But let's dive deeper into CSRD.

What is CSRD all about?

CSRD, Corporate Sustainability Reporting Directive, expands the number of companies subject to sustainability reporting requirements. The CSRD replaces the NFRD (Non-Financial Reporting Directive), which is already part of the Accounting Act.

In the heart of the CSRD is so called double-materiality. This means that businesses need to be aware of their impact on the environment and society and understand the sustainability risks, such as climate risks, that they themselves face.

CSRD will also make sustainability matters a mandatory part of companies’ financial statements and annual reports. Sustainability reporting must also be integrated into audits and verified by third parties. It also stipulates that companies must report relevant information to a pan-European information system.

CRSD reporting will be guided by the ESRS (European Sustainability Reporting Standards) standards, that are currently in preparation. These will enter into force at a later date.

Who does the CSRD apply to?

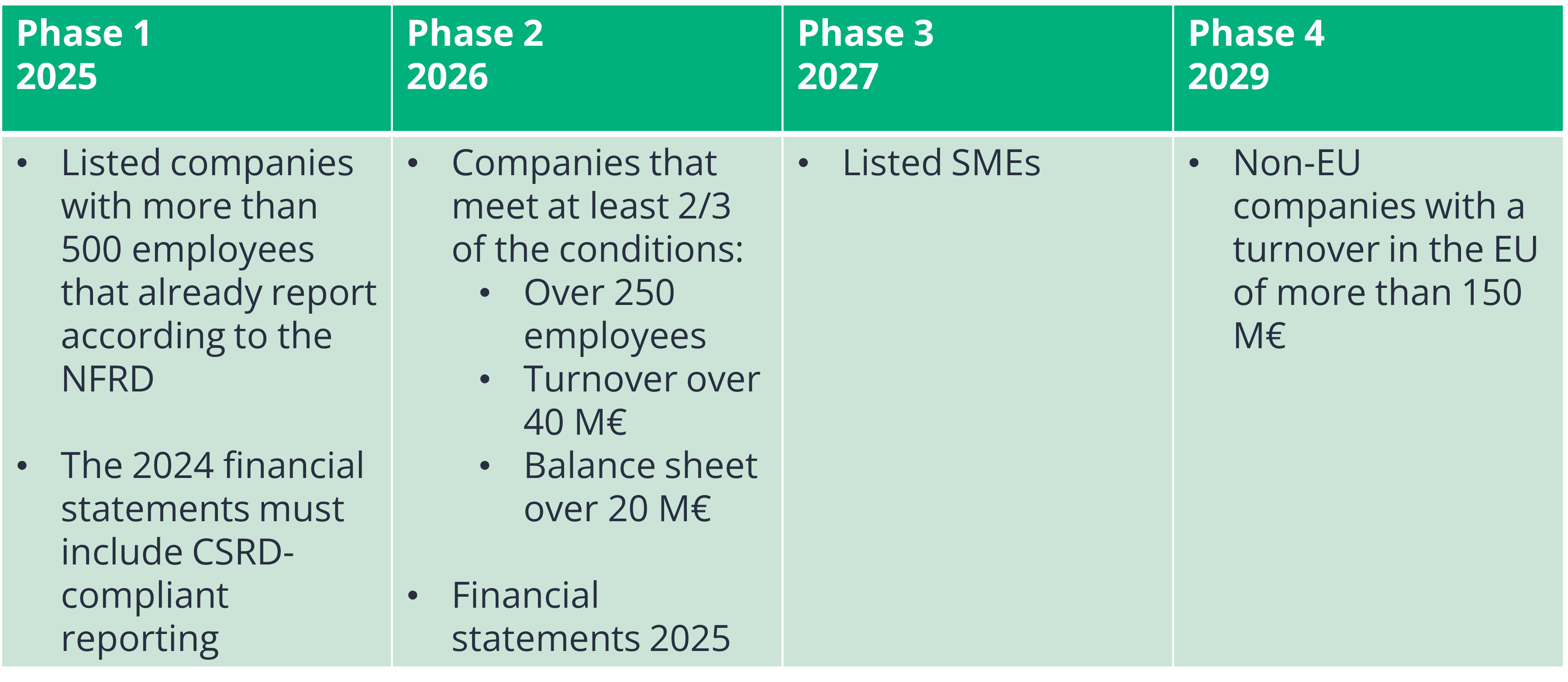

CSRD reporting will apply to different companies at different phases (see figure below). The main point to remember is, that the reporting relates to the financial statements for the year ended. The first phase will come into force in 2025, meaning companies will report data for 2024 (note, this is already next year!). So, if a company belongs to the first phase, it should know already next January what data it needs to collect and start preparing for reporting.

The CSRD reporting will also affect companies that are not strictly bound by it. Companies subject to the CSRD are likely to require similar reporting from subcontractors and other actors in their own value chains, meaning that in practice the reporting changes will affect a much larger number of companies.

What to report?

The details of CSRD-reporting will be determined by future ESRS standards. The commission is expected to adopt some of the standards in 2023 and the rest during 2024. ESRS preparation has been carried out in cooperation with the GRI.

The issues to be reported are:

- Business model and strategy

- Objectives related to sustainability matters

- Role of governance, management and supervisory bodies

- Sustainability-related policies

- Incentive schemes

- Sustainability-related risks

- Due diligence processes

- Actual and potential adverse impacts AND measures taken by the company to prevent, mitigate, remediate and eliminate them

- Indicators

The standards are expected to be fairly comprehensive, so the workload is reasonably large. Reporting will be consistent and unified, so the importance of other sustainability communication will be highlighted as a means of differentiation.

Sustainability reporting in the future

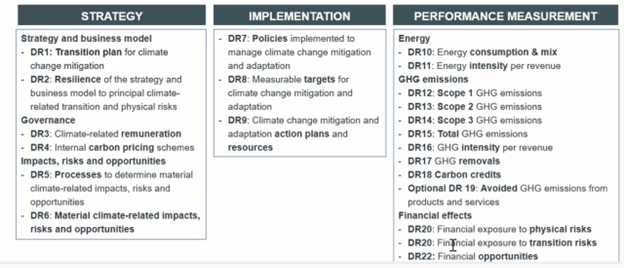

In the future, companies will be expected to report on sustainability issues in a transparent, clear and detailed manner. The three main points will be strategy, implementation, and performance measurement.

In the strategic category companies are expected to report on sustainability risks, opportunities and impacts relevant to the strategy and business. The point here is that different obligations are also opportunities. For example, climate change mitigation will lead to a strong increase in demand for new technological solutions and services. This gives companies that are alert great opportunities to succeed in the future.

In terms of implementation, the issues to be reported are company policies, objectives, action plans, resources and responsibilities. Companies need to make transparent how they are planning to reach these goals, what kind of resources they are using and who is responsible for carrying out the planned action points.

Performance against the company’s objectives must be measured and reported. In practice, this means what has been achieved and what progress has been made. Measuring and reporting on the targets ensures that the company not only talks the talk and markets itself on sustainability issues but must concretely demonstrate that it is living up to its word. Measurement is also essential to ensure that the results are comparable against the targets.

Reporting is a tool for sustainability management

By reporting, a company can see in stark and concrete terms the state of its sustainability and governance – whether its main impacts on the environment and the world around it are clear and measurable, how sustainability is reflected in the company’s strategy and the board’s agenda, and what measures have already been taken and whether the targets set have been met.

Companies should prepare for the change by checking whether the CSRD requirements apply to them directly or perhaps indirectly (whether they are part of the value chain of another company that is subject to reporting) and when the changes will apply to them.

Companies should also review the new reporting requirements and make it clear to themselves how much they differ from their current reporting. It is also important to draw up an action plan on how to bridge any potential gap. Once everything is clear, companies should define clear responsibilities for implementing the needed measures.

However, it should be remembered that reporting should not be done for the sake of reporting. Businesses have an excellent opportunity to develop and improve their own operations and make a real social impact. Each company can increase its own role in the green transition.

If you have questions regarding CSRD requirements or sustainability reporting, you can always book a meeting with us. We'll be happy to help you in all of your reporting needs!

Published 16.05.2023